What are the drivers of a value for a building??

Current ways to understand the drivers of real estate value rely on the hedonic asset pricing model. It is a simple multi-variate framework that attempts to explain the drivers of a building’s price, rent, appraisal value, cost, etc.. Although crude, it is the work horse behind asset pricing econometric (explanatory) and machine learning (prediction) objectives. Yet, given its role, this model aims to elegantly measure the drivers of utility that users are willing and able to pay for.

To execute these models, real estate asset pricing modelers consider the following as dependent variables for driving asset valuation: building size, age , number of stories, status of renovation, location and proximity to CBD, all of which describe only the crudest elements of a building that have already been specified as guidelines prior to the design of the physical structure. Designers, on the other hand, consider much more qualitative and tactile elements of architecture during the design process – such as materiality, geometry, daylight, views and spatial transformability – to cater to both functional and aesthetic needs. These features and characteristics that differentiate building from the building are entirely dismissed and overlooked by the current financial practice of commercial real estate valuation, either due to previous lack of means to collect data about building features or due to lack of interest and knowledge from the ends of the valuation parties unacquainted with the language of design. However, omitting these features from asset valuation leaves a missed opportunity to understand the extent to which the actual design and function of a building impact the market value of a property during individual real estate transactions, thereby diminishing the agency of design during negotiation processes. Therefore, we ask, how does design contribute to value?

In recent years, advancement in data technologies and computing has enabled data collection and analysis of the built environment at unprecedented scales. As a young field of scholarship that emerged since 2006, Urban Informatics is understood as “the study, design, and practice of urban experiences across different urban contexts that are created by new opportunities of real-time, ubiquitous technology and the augmentation that mediates the physical and digital layers of people, networks and urban infrastructures” (Foth, Choi, Satchell, 2011). Enormous torrents of data tabulating the spatial, economic, social and environmental metrics of the urban environment launch an expanded repertoires and tools in understanding the built environment from a quantitative approach. A new palette of tools, including advanced 3D modeling techniques, digital environmental simulations, pervasive computing, distributed sensors, machine-learning algorithms as well as crowdsourcing platforms, allows us to understand the built environment from multiple perspectives. Data is the new common denominator that connects both physical and emotional, abstract and concrete elements of inhabitable space.

Returning to the discussion of methodologies used in the valuation practice in real estate, we realize how myopic of a scope the built environment is currently observed at. The information that is fed into the valuation model presents only a minuscule fraction of the large data sets and features we are equipped to gather. We propose to devise a set of design metrics to provide reference and guidelines for both designers and developers and to buy in the agency from both sides from an investment perspective.

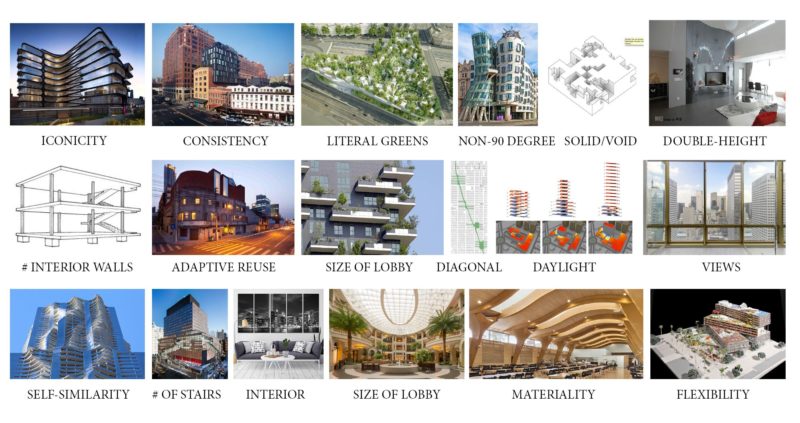

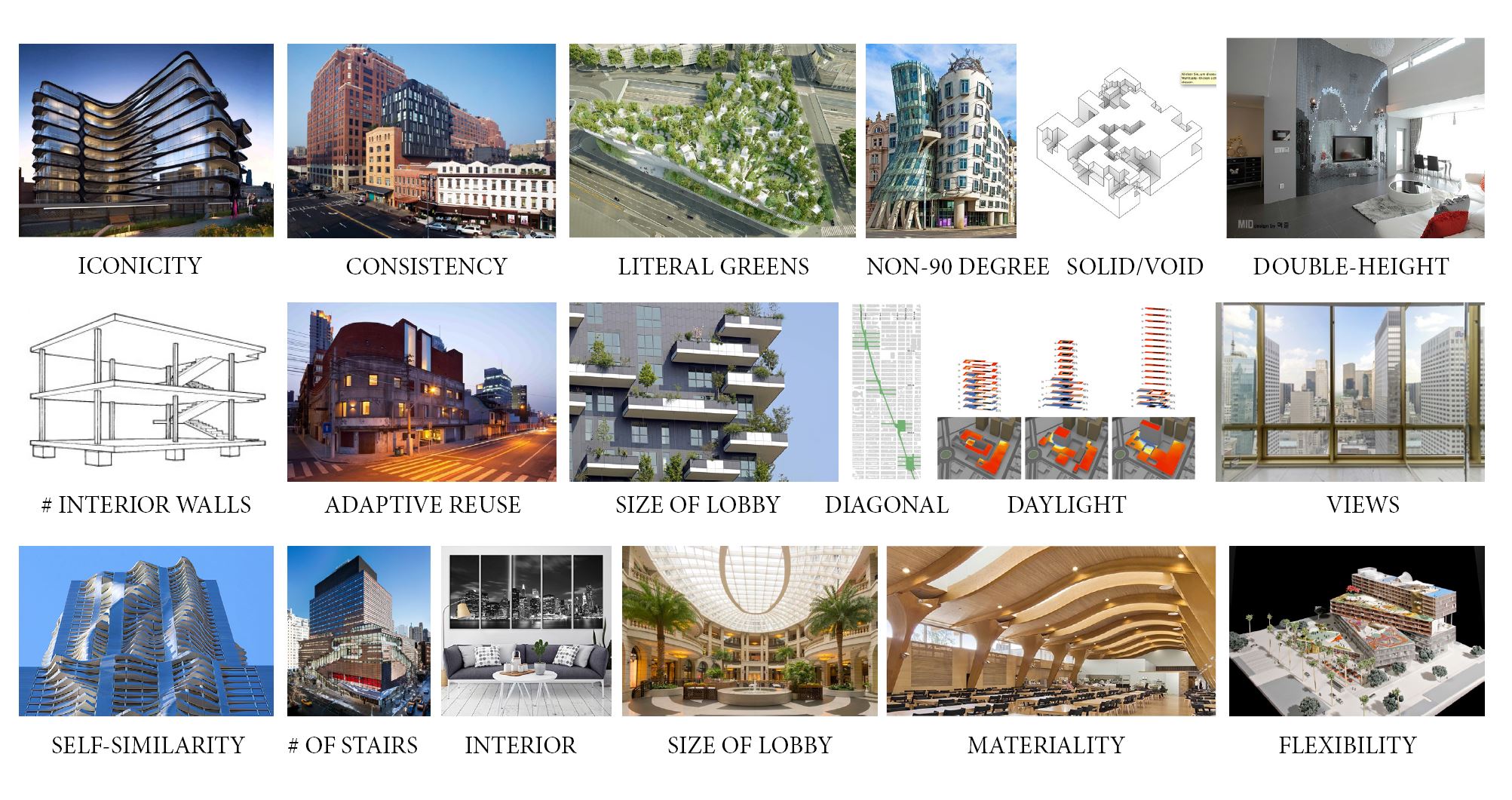

We identify the following design elements as quantifiable features which we can collect and evaluate to construct correlations between design and real estate market value.

- Iconicity: measures the recognizability of a built structure and its cultural impacts

- Consistency and variations: measures how different a building is from its surroundings

- Literal greens: quantifies the percentage of vegetation and green surfaces

- Non-90 degree angles: quantifies the non-orthogonal moments in a building

- Public-to-private ratio: measures the amount of public space within a building

- Spatial flexibility: measures how adaptive and transformable are the spaces

- Materiality: measures both interior and exterior use of materials

- Size of the lobby: measures how grand is an entrance

- Interior design: a dummy variable which checks whether a reputable interior designer is onboard with the project

- Solid void ratio: measures how articulated is a building by calculating surface to volume ratio

- Double or triple height spaces: measures the amount of “tall spaces” of a building

- Number of interior walls: measures the openness of a space

- Adaptive reuse buildings: a dummy variable which checks whether a building has had a previous programmatic identity

- Balconies: measures connection to the exterior

- Diagonal vs. grid: measures whether urban form impacts the market value

- Daylight: quantifies the amount of daylight each space receives

- Views: quantifies the contents of a view

- Levels of customization: assess how similar a building is to itself (the degree to which customized parts are used)

- Number of staircases (non-fire-stairs): measures the usage of staircases as an expression of design

- Number of entrances: measures degrees of accessibility

Within each metric, this research explores the variation of the metric in relation to financial value terms through performing autoregressive models. From the perspective of the designer, such expanded valuation methods would bring the agency to design and provide useful feedback, which helps bring design out of its current black box environment to a framework that is more autonomous, responsive and sympathetic.