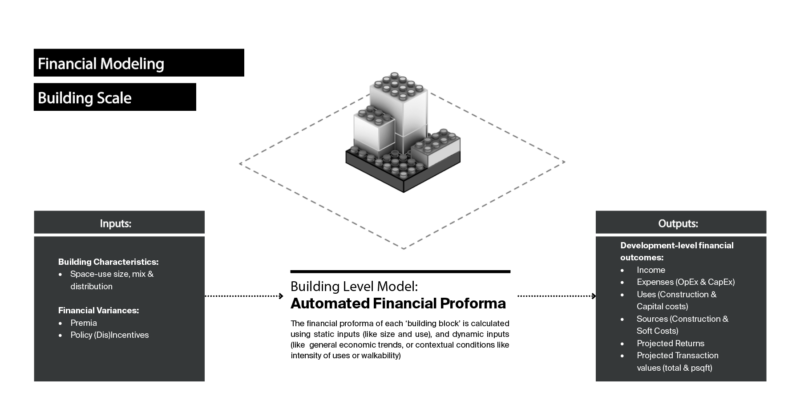

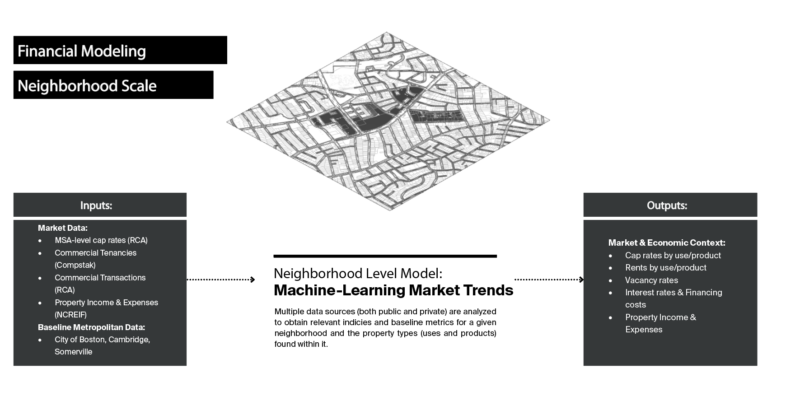

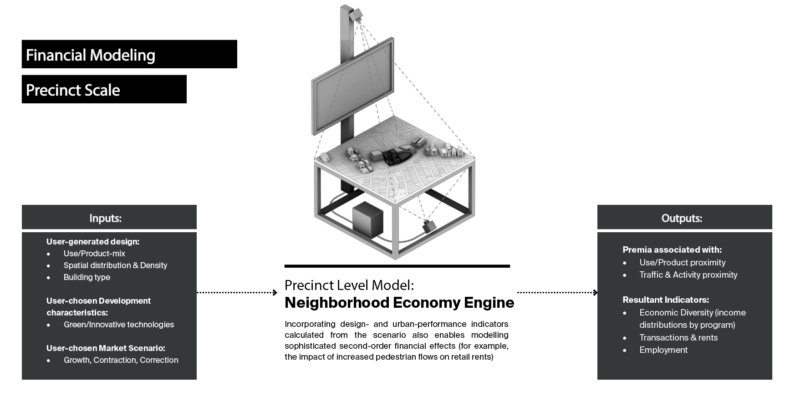

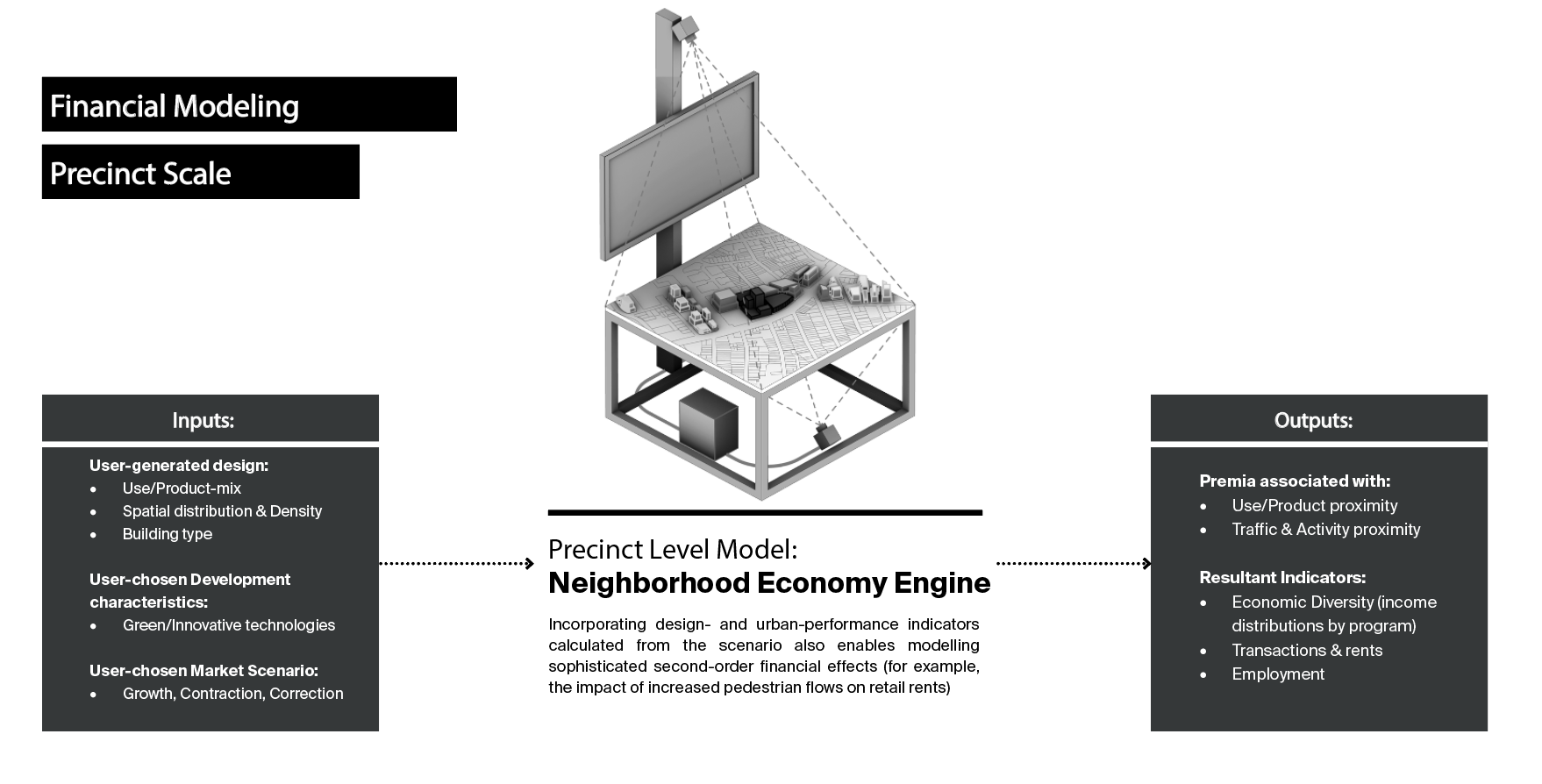

MIT’s Real Estate Innovation Lab is developing computational frameworks that integrate architectural and urban design into financial econometric methods, in order to automatically calculate real estate pricing and development valuation. To effectively value a future real estate development at scale, we need to create wide data platforms that can integrate numerous disparate data frameworks into one data system. Using the Wide Data Experiment’s Geometric, Geospatial and Relational Databases, we have developed a framework for starting to test valuation forecasts in the urban scale. We do so in three distinct ways – at a building, neighborhood and precinct level. Then using machine learning techniques we begin to forecast the valuation outcomes and develop the workflow to output it into a framework.