In this paper, we investigate the impact of a nascent entrepreneurial amenity for urban agglomeration, accelerator programs, upon start-up firm’s private equity performance. Accelerators are firm development programs that utilize physical space, human capital development programming, mentorship, financial capital, and community engagement to accelerate the financial feasibility of start-up firms. A sample of US accelerator treated and matched control firm’s over the 2005 to 2015 period yields a study of 16,720 firms. Results indicate that there is statistically significantly more cumulative funding for accelerated firms, when taking into consideration the endogenous choice and selection of start-up firms into programs and series stage in cumulative funding. Secondly, we assess variation across accelerator participation timing and find that firms with pre-funding when coming into an accelerator leads to higher cumulative funding. Lastly, we document accelerator program’s ability to cultivate agglomeration through space and programming amenities like free physical space, program length, program cohort size, investor equity stake and scale of capital injection impacts upon cumulative funding. This study supports evidence of correlation between start-up firm performance and accelerator program amenities. Accelerators can have significant impact on the life-long health of young private-equity firms.

Is Innovation Really in a Place? Venture Accelerator Program Impacts on Firm Performance

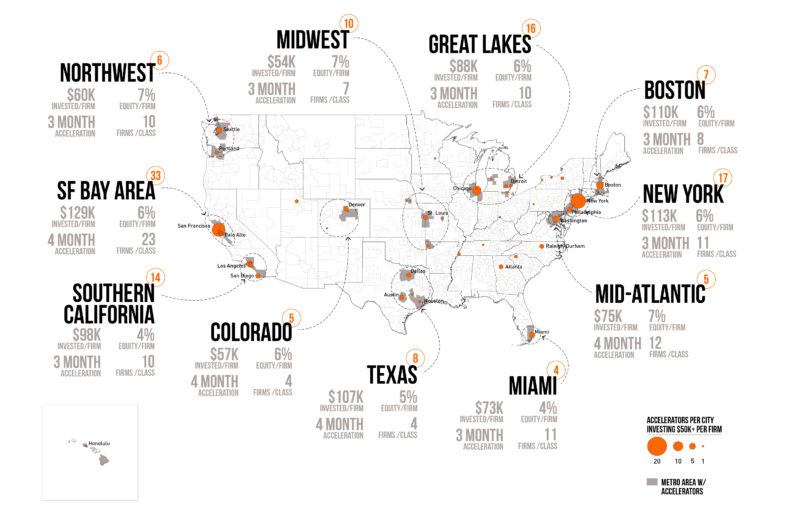

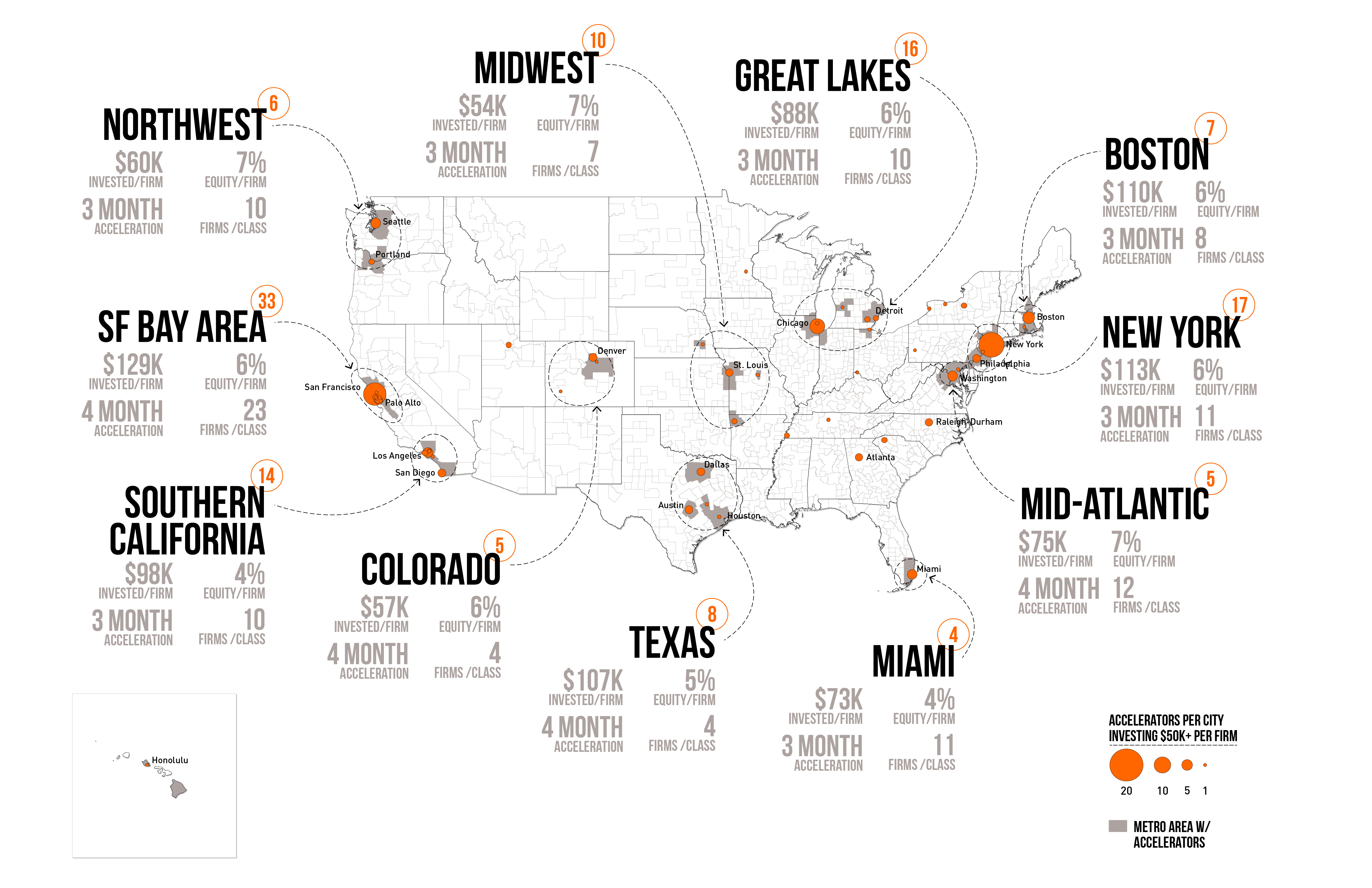

Ever wonder whether venture accelerator programs have an impact? Does it make a difference what type of program a startup firm goes into? Or what type of amenities both spatial and activity wise impact their outcomes? This paper digs into what accelerator programs are out there in the US, documents program differences and measures how those differences impact startups' ability to raise capital in the private equity environment.