This study expanded the conversation on the value of design by investigating the transaction prices of commercial buildings associated with award-winning architects/firms and their building design in Manhattan over the 2000 to 2017 period.

In line with the relative studies using the awards as means to identify architects who have won high status among their peers, this study intended to broaden the scope of understanding design by adding substantially more controls in the model: incorporating buyer and seller decisions for all of the transaction over time, specifying the type of awards, and adding information on architects to every building in the sample data set. The added variables improved the overall fit of the model as well as explaining the variation in price. It is important to bear in mind that this empirical study does not intend to measure the weighted skillfulness or profitability of individual architects/firms. In essence, this study is an endeavor to recognize the authorship of each building and study their impact on the price dynamics of commercial office buildings in Manhattan, New York.

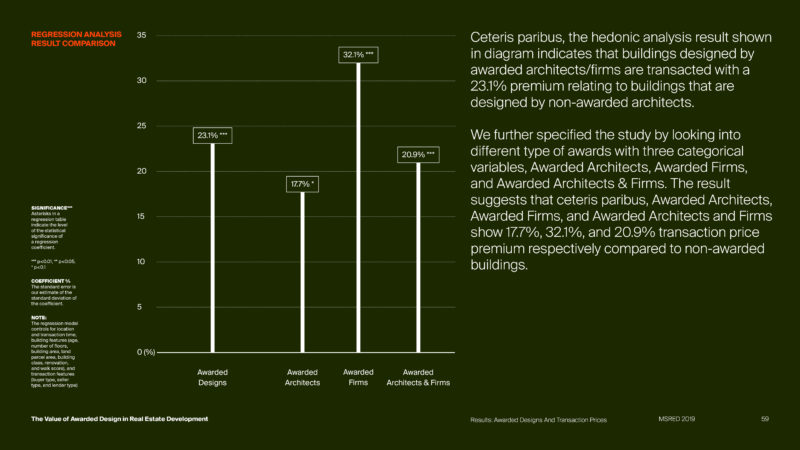

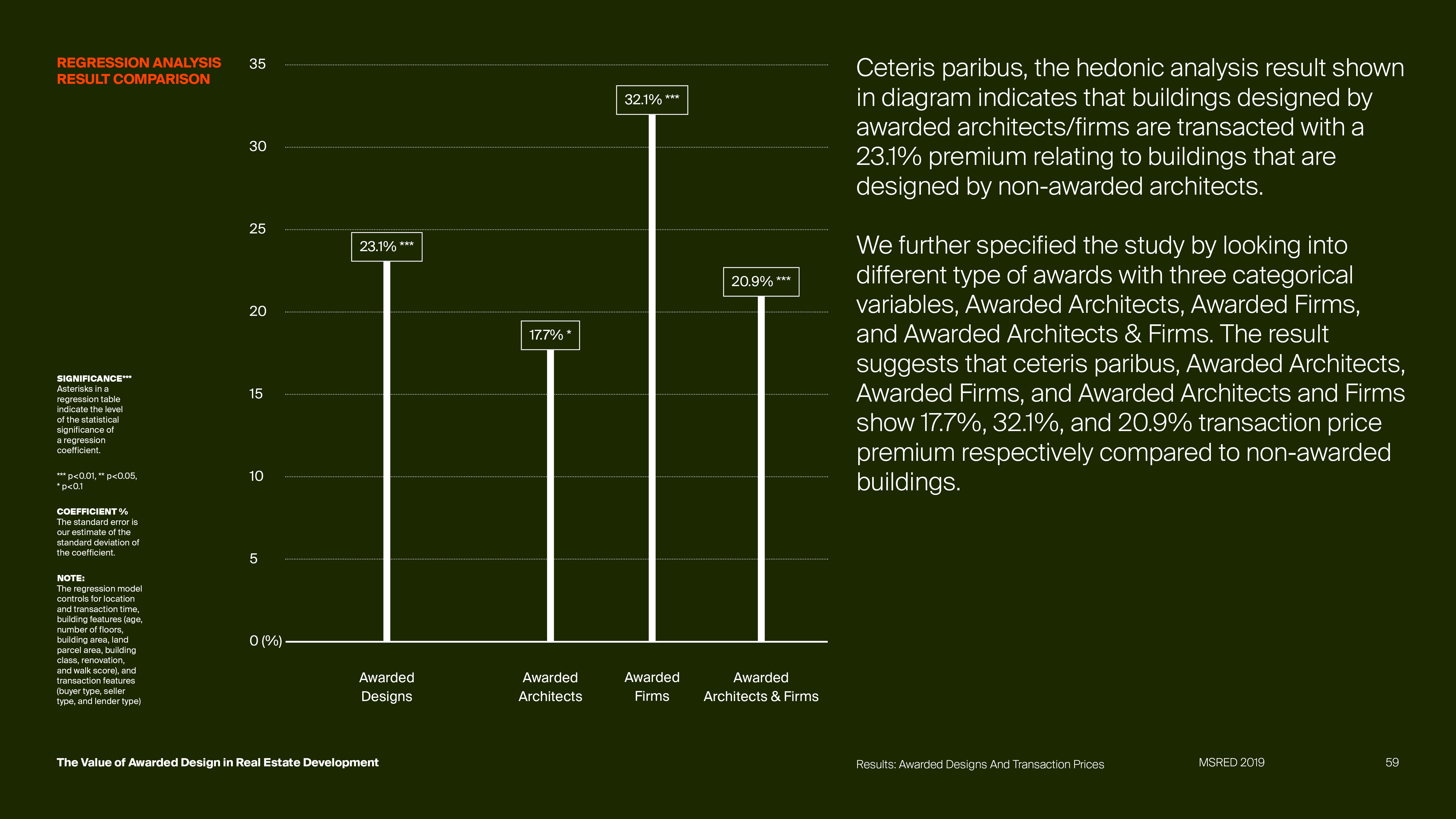

When controlling for location and transaction time, building features and transaction features, the result of the hedonic analysis suggests that buildings designed by awarded architects/firms are transacted with a 23.1% premium than buildings that are designed by non-awarded architects. We further specified the study by looking into different type of awards with three categorical variables, Awarded Architects: who have won lifetime achievement awards and/or contemporary innovation awards, Awarded Firms: companies that have received the AIA Architecture Firm Award, and Awarded Architects & Firms: who have won both the lifetime achievement award/innovation award and AIA Architecture Firm Award. The result suggests that ceteris paribus, Awarded Architects, Awarded Firms, and Awarded Architects and Firms show 17.7%, 32.1%, and 20.9% transaction price premium respectively compared to non-awarded buildings.

Moreover, we have expanded the categorical variable to study the relative transaction premiums associated with awarded architects using the non-awarded architects as a base case. Ceteris paribus, the result shows a significant transaction premium of 60.6% on the buildings designed by Ludwig Mies van der Rohe relative to the buildings designed by non-awarded architects, followed by KPF (51.4%), and Hugh Stubbins and Associates (27.4%). However, the suggestive results should be treated with extra caution due to the small number of observations related to each architect and firms. The result does not suggest any measurements related to the architecture firm’s performance since the results are based on a small differentiating sample. On average 4.9 transaction observations were found per architect.

In general, this study has focused on a quite precise subject that is to understand and acknowledge the architect’s influence on the commercial office building’s transaction value. In other words, it was a mere attempt to figuratively understand the value associated with the designers of the built environment. The results indeed show a significant premium associated with the architects, however, it only illustrates a small part of the relationship of design and value that is based on price rather than the performance of the building design. Further improvement can be made by integrating the related cost associated with the design and identifying other potential omitted variables: for example, the premium associated with the awarded architects may be influenced by the larger SF of a building, higher construction budget, better interior quality, or other endogenous factors.

In recent years, due to increased market education and growth in the number of leading examples, investing in high-quality design became a standard for the real estate market in New York. Despite the growing interest, however, a limited number of studies and discussions have been generated to help create a shared better valued surrounding the subject of design. In this study, we have identified the difficulty of obtaining data related to design performance being one of the biggest hurdles in enabling further studies to disentangle the value of design. As a first step, a creative approach in gathering a new set of data related to the design performance is needed. For example, the design-related elements that we found in the buildings that have gained significant transaction premium, such as iconicity, relevance in a certain industry, adopting the most innovative construction technology, rich cultural and historical background, high-quality interior, can be studied as new data points in the future studies. We believe combining the new measurements with the accumulated knowledge on design generated by architects will enable us to open up a substantial area for future research regarding the value of design, and moreover will help create an agency for design in the realm of finance and economics ■